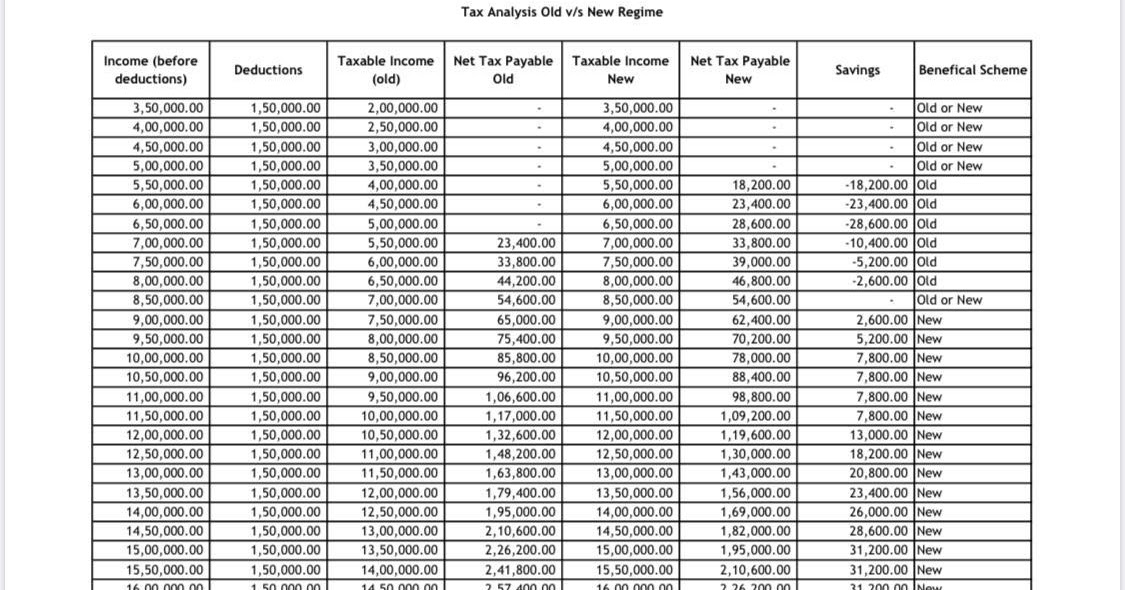

The key, of course, is reducing your taxable income. Tax professionals spend countless hours trying to move their clients into a lower tax bracket.

FEDERAL WITHHOLDING TAX TABLE 2020 HOW TO

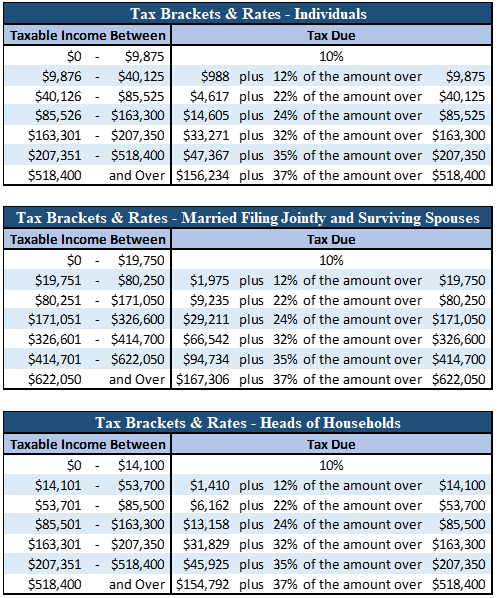

He can be reached for comment at Also: Teachers Federal Credit Union Ny How To Get Into A Lower Tax Bracket And Pay A Lower Tax Rate He works with people across the country on their financial planning needs through Purposeful Strategic Partners, a fiduciary and fee-only financial advisor and a Registered Investment Advisor. Joshua Escalante Troesh, CFP, is a Tenured Professor of Business and the founder of Purposeful Finance. Visit our challenge page and commit to build your financial plan one week at a time. Each week you will receive a simple action item to take to improve your financial situation. In just a few minutes a week, you can move toward financial independence. So, thats something else to keep in mind when youre filing a return or planning to reduce a future tax bill. However, for head-of-household filers, it goes from $55,901 to $89,050. For example, for single filers, the 22% tax bracket for the 2022 tax year starts at $41,776 and ends at $89,075. The 20 tax bracket ranges also differ depending on your filing status. Whats the Standard Deduction for 2022 vs.That means you could wind up in a different tax bracket when you file your 2022 federal income tax return than the bracket you were in before which also means you could pay a different tax rate on some of your income. However, as they are every year, the 2022 tax brackets were adjusted to account for inflation. When it comes to federal income tax rates and brackets, the tax rates themselves didnt change from 2021 to 2022. For most Americans, thats their return for the 2022 tax year which will be due on Ap. Smart taxpayers are planning ahead and already thinking about their next federal income tax return. Recommended Reading: Western Healthcare Federal Credit Union Depending On Your Taxable Income You Can End Up In One Of Seven Different Federal Income Tax Brackets Each With Its Own Marginal Tax Rate You May Like: 2021 Traditional Ira Income Limits Our partners cannot pay us to guarantee favorable reviews of their products or services. This may influence which products we review and write about, but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. So how do we make money? Our partners compensate us. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free. We believe everyone should be able to make financial decisions with confidence. For example, you’re subject to three different tax rates if your taxable income is $50,000 as a single filer. But it’s important to remember that not all your income is taxed at this rate. Your tax bracket is your marginal tax bracketthe one in which your uppermost dollar of your taxable income places you. The income limits and maximum credits don’t change much for 2022unless you don’t have children, in which case you’ll have a harder time qualifying : EITC for 2022 Here are the EITC AGI limits and maximum credit amounts for 2022: As a refundable tax credit, taxpayers may be eligible for a refund even if they have no tax liability for the year. The earned income tax credit is a refundable tax credit that helps lower-income taxpayers reduce the amount of tax owed on a dollar-for-dollar basis.

FEDERAL WITHHOLDING TAX TABLE 2020 UPDATE

ProContractor – How to Update the US, Federal & State Tax Tables 2020 – 2021

0 kommentar(er)

0 kommentar(er)